Gold hits new heights. An expert explains what is pushing up the price

From cryptocurrencies to Treasury bonds, there are all kinds of places to invest your cash in 2025. So, why is gold — one of the oldest investment vehicles in history — reaching record prices?

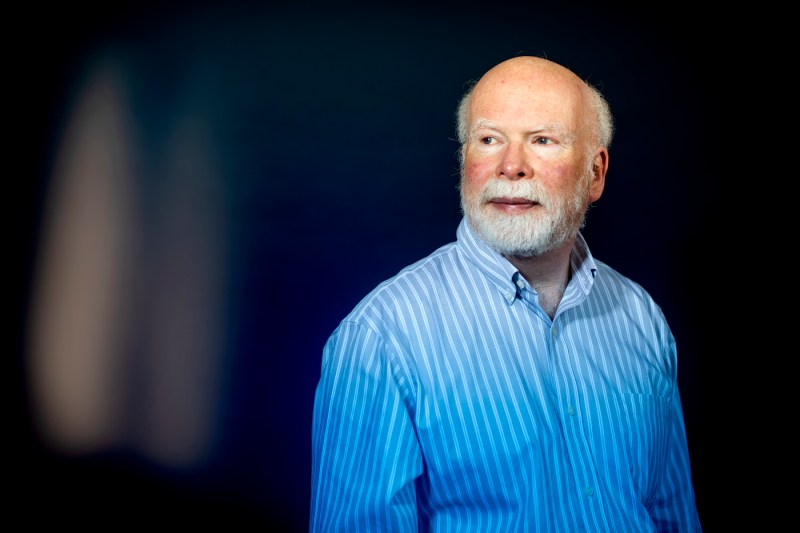

Northeastern University economist Bob Triest says some things are classic.

“Gold is a classic safe-haven asset,” says Triest, professor of economics at Northeastern. “The main link to the economy is that the run-up of the price of gold reflects the increase in economic uncertainty.”

Gold prices topped $4,000 a troy ounce (the global standard of weight for precious metals) for the first time on Tuesday. The price of gold has risen about 50% this year and, on Monday, Goldman Sachs raised its December 2026 price forecast for gold from $4,300 per ounce to $4,900.

Triest says several factors causing economic uncertainty are likely influencing the run-up in gold.

Trade policy — with tariff rates uncertain, as well as the effects of tariff rates — and geopolitical risks contribute to uncertainty in exchange rates among currencies.

“These make gold attractive relative to sovereign currency-denominated assets, like short-term government bonds,” Triest says.

Editor’s Picks

Uncertainty in trade policy and geopolitical risks also contribute to uncertainty over inflation in the United States, Triest adds.

“U.S. inflation uncertainty, arising from the uncertain effects of tariffs and the political pressure on the Federal Reserve to cut rates, is also likely playing a role,” he says.

That being said, Triest notes that gold prices have been rising since before the 2024 U.S. presidential election.

“So, it’s uncertain how much effect the recent increase in uncertainty associated with policy has had on the price of gold,” Triest says.

But regardless of the impetus, both individual investors and global central banks are looking for a safe place to put their cash — and are seeing gold.

Triest explains that some investors use gold as a place to park money when other “safe investments” that are tied to currency — for instance short-term Treasury bonds — are uncertain due to inflation volatility and when other alternative assets are perceived to be “especially risky and/or overvalued.”

Meanwhile, central banks may be increasing their gold purchases to partially, as Triest says, “de-dollarize” — or get rid of stockpiles of the weakening American dollar — and diversify reserves.

So, are we in the midst of another gold rush?

The price of gold already factors in future changes in bond yields, expected events like a Federal Reserve rate cut and even that policy is likely to change, Triest says.

But he says any deviation from expectations will likely affect gold prices. For instance, if the Fed cuts by more than currently expected, putting downward pressure on bond yields, that would tend to push up the price of gold further. Similarly, increased uncertainty regarding future economic activity would also contribute to upward movements in the price of gold.

Is it time to sell the family heirlooms?

“The family heirlooms might also be a decent safe-haven asset,” Triest says. “But it still might be a good time to sell them if you don’t like them!”